Price Impact, Slippage and Safe Mode

Price Impact, Slippage and Safe Mode

Understanding Price Impact, Slippage, and Safe Mode

Price Impact

Price Impact is the change in a token price that is directly caused by your trade and reflects how much total liquidity is available for the token you are trading.

Price Impact is directly correlated with onchain liquidity. The more Liquidity held in liquidity pools, the lower your Price Impact may be and vice versa.

Price Slippage

Price Slippage is the change in token price between the expected price and the executed price that you receive.

Slippage is the change in actual tokens between what you expected to receive to what you actually received when executing a Swap.

Slippage can occur:

During market volatility

Due to a lack of liquidity

Slippage Settings

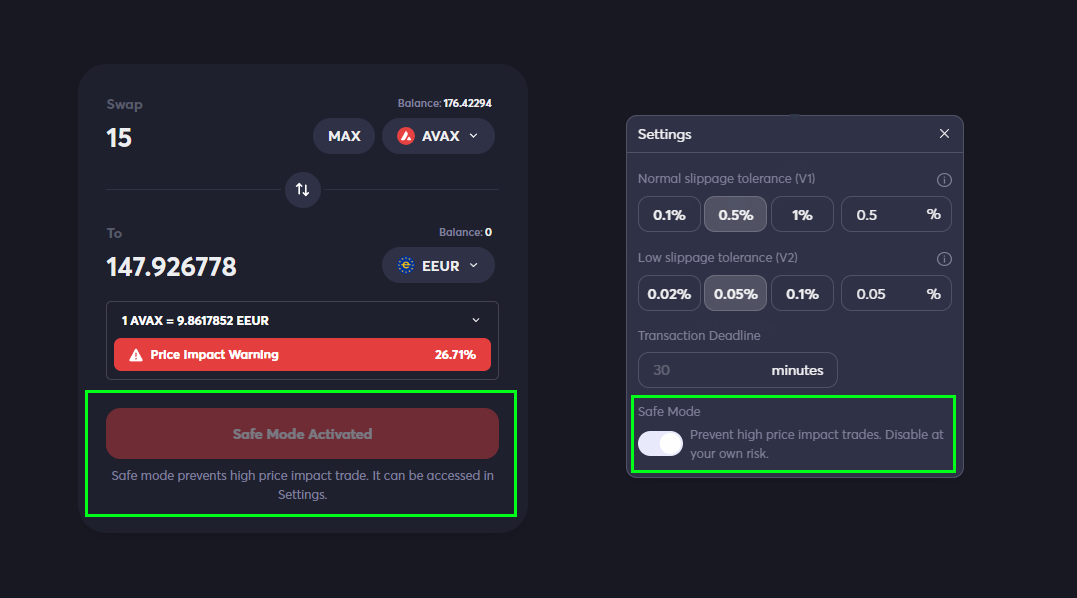

You can adjust your Slippage settings to reduce the % of Slippage during Trades. If a Trade experiences Slippage that is higher than your Slippage Settings, the Trade will revert and cancel.

Safe Mode

If your Trade causes a price impact that is over 5% you will not be able to execute the Swap unless you turn off 'Safe Mode'. Turn off Safe Mode by clicking on the Settings button and then toggling off 'Safe Mode'.

General Disclaimer

This document is intended for informational purposes only and should not be construed as financial, legal, or investment advice. The contents of this document do not constitute an offer or solicitation to buy or sell any tokens or participate in any trading strategies. The decision to trade tokens involves substantial risk and should be made independently by the reader with consideration to their financial situation and investment objectives.

Last updated